Deal and relationship management for investment banks

Win business faster with unified deal

and relationship management

Boost win rates and increase operational efficiency with an all-in-one deal and relationship management solution.

Access the relationship intelligence, market trends, and actionable insights needed to build stronger relationships and accelerate deal execution — all with Intapp DealCloud for investment banking and advisory.

Spark new value for investment bankers and advisors with Intapp DealCloud

Ensure a centralized, collaborative deal process from prospecting through execution.

Build deal-winning relationships

Discover and nurture client connections with powerful relationship intelligence.

Source more business

Identify new opportunities using centralized data and insights.

Improve client outcomes

Give your team the tools needed to exceed client expectations.

Off-the-shelf capabilities specifically

designed for your business

[Intapp] DealCloud … offers off-the-shelf capabilities specifically designed for our business that we don’t see with other large CRM platforms. The platform will provide new insights … and enable us to maintain a high level of client service.

Gain a competitive advantage with actionable intelligence and marketing tools

Enhance relationship management

Strengthen relationships with AI-driven intelligence reporting and automated data capture.

Simplify email marketing

Make outreach easy by designing, sending, and analyzing branded email campaigns.

Accelerate business development

Discover new opportunities by monitoring corporate and sponsor relationships alongside market activity.

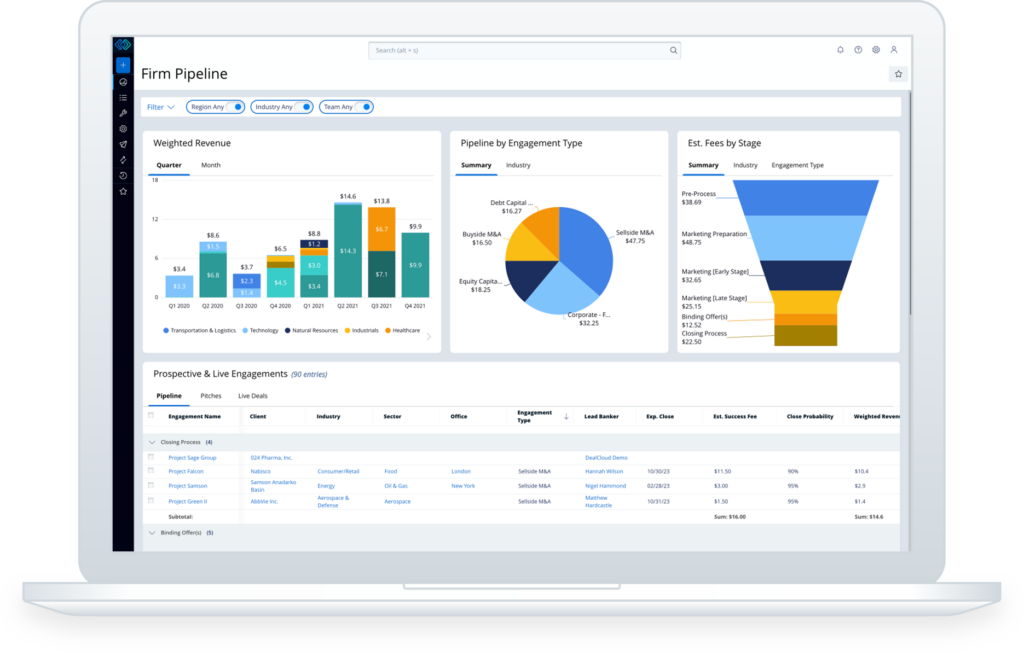

Improve pipeline management

Achieve better outcomes by centralizing target pipeline, maximizing resource allocation, and forecasting estimated fees.

Fast-track deal execution

Streamline workflows with on-demand buyers list development, deal marketing, and reporting.

Centralize firm knowledge and strategy

Maintain a single source of truth for pipeline, deals, fees, and client coverage.

Leading investment banks use Intapp DealCloud

for deal and relationship management

Drive deal progression with unified workflows and actionable insights

Real-time institutional knowledge sharing

Improve communication and decision–making with workflows and intelligence all in one place.

Automated workflows, alerts, and reports

Stay up to date with deal to-dos with automated task workflows, notifications, and AI-generated signals.

Configurable reporting and analysis

View firmwide pipeline and inform deal execution with ad hoc and templated reports.

AI-driven insights

Save time with AI-driven deal summaries, and make better decisions with AI recommendations based on firm and market intelligence.

Extensive system integrations

Share data across your firm with a centralized hub that integrates third-party data, Microsoft 365, and other applications your team uses daily.

Secure mobile access

Use iOS and Android apps to work from anywhere, view and search data, take notes offline, and sync when reconnected.

Frequently asked questions about Intapp DealCloud for investment banking

-

The complex dynamics of today’s fast-moving markets demand that investment bankers and M&A advisors become more agile. Building strong relationships, effectively managing pipeline, and obtaining visibility into active engagements is challenging when data is stored in unorganized or disparate systems.

Intapp DealCloud is built specifically to help investment bankers and advisors boost win rates by providing insights into relationships, pipeline, and market trends within one platform. Developed by industry experts, DealCloud helps firms drive a centralized, collaborative, and uniform deal process from prospecting through execution.

Regardless of your firm’s size, strategy, clients, or operating model, DealCloud provides the crucial data and intelligence you need to achieve the best outcomes for your clients.

-

Intapp DealCloud lets you track a wide variety of deal data including sourcing, progress, and staffing details — helping you manage deals throughout the entire lifecycle. Integrated workflows, pipeline analytics, and configurable reports provide real-time deal insights so your team can make informed decisions.

-

Yes — Intapp DealCloud for investment banking can be customized to meet your firm’s specific requirements. Built by industry experts, the solution is designed to accommodate varying pipeline, relationship management, and reporting needs. It can be configured to support the unique needs of individual users, teams, and divisions. Access levels may be provisioned on a user-by-user basis.

Schedule a demo

Speak with an investment banking and advisory industry expert

Fill out the form and someone will be in touch to provide a demo.

Intapp Intelligent Cloud

For more than a decade, Intapp has been bringing the power of automation and intelligence to professional and financial services firms — helping clients like you solve their specialized needs and challenges.

Intapp Cloud Infrastructure

Use AI confidently, knowing we keep your data secure through our partnership with Microsoft and our own commitment to security and compliance.

Learn more about our cloud infrastructureIntapp Data Architecture

Quality data is at the heart of good AI — and with Intapp, you benefit from our data architecture.

Learn more about our data architectureIntapp Applied AI

Our Applied AI strategy includes five essential AI capabilities that help you make smarter decisions, faster.

Learn more about our Applied AI strategy